what is a good cap rate on apartments

There are no standard ranges for the good or bad cap rates. It all depends on the market and context.

The cap rate can be helpful in quickly comparing the relative market value of real estate investments. However, it should never be used as the only indicator of investment strength.

Lower cap rates indicate less risk while higher cap rates represent greater risk. You can choose which investment type you prefer.

There are no standard ranges for the good or bad cap rates. It all depends on the market and context.

A cap rate is key to being a successful real property investor. Although it may sound mathematical, a cap rate has practical uses. You can use this concept to choose a market, property type, invest criteria, analyze, and then decide when or if you want to sell a house.

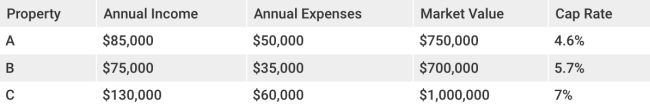

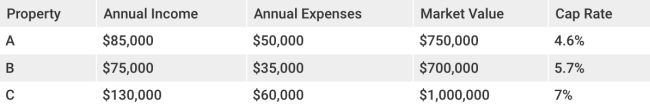

Different cap rates can be applied to different properties. It is evident from the formula that properties that have lower net operating income and a higher valuation will have a higher caprate value.

When it comes to cap rates, what is the best rule of thumb? Higher cap rates can be found in better neighborhoods while lower rates can be found in more deprived areas. The next time you see an "irresistible 15% caprate property," you can usually assume that it isn't in a great community.

Real estate investing is all about doing your research. It's crucial to minimize risk and maximize return. A thorough analysis of your investment property is essential before you buy an income property. You must be able run the numbers and make a decision whether it's a good idea. The cap rate formula is used by many investors to analyze real-estate deals. But, there is no definitive answer to the question: "What is a good price?"